The European solar module market has reached a “state of equilibrium” in recent weeks, with stable prices and regular demand.

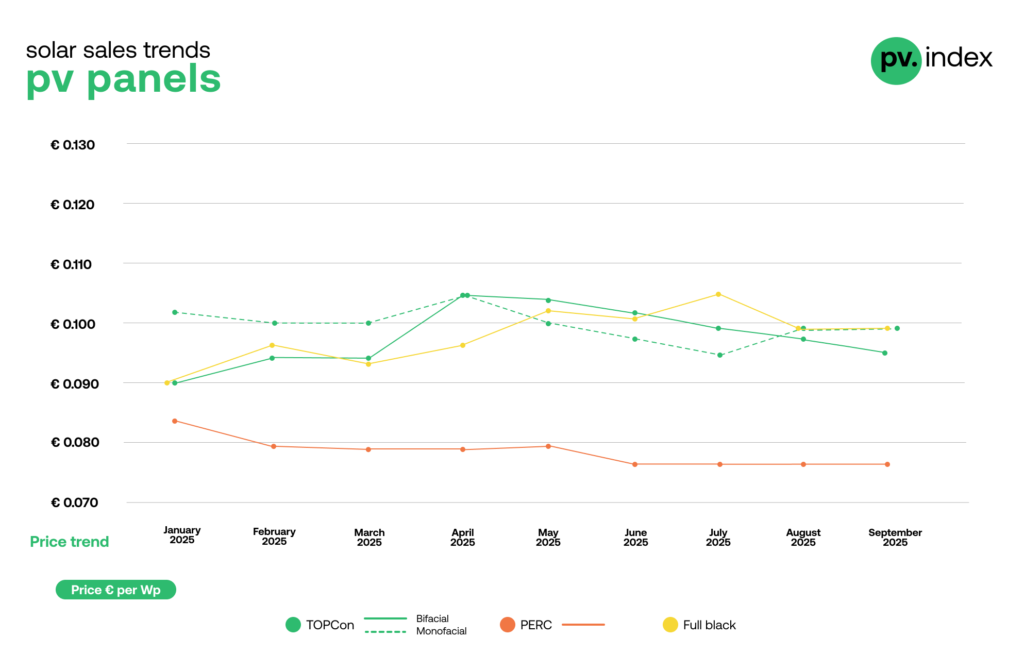

The latest pv.index report from online solar marketplace sun.store shows that prices for passivated emitter rear contact (PERC), monofacial tunnel oxide passivated contact (TOPCon) and full black modules all remained steady in September 2025. The report said that the stability reflected “balanced supply and stable demand” of TOPCon modules and the attraction of cheaper PERC panels for “cost-driven projects”.

Only bifacial TOPCon modules saw a slight, 2% price decline, from €0.097/Wp (US$0.11/Wp) to €0.095/Wp, which sun.store called a “moderate” change after months of stability.

“After two years of rapid price corrections, the sector is now finding balance between production capacity, pricing and demand,” said Filip Kierzkowski, head of partnerships and trading at sun.store.

Leading solar module suppliers

One change in September was the replacement of Chinese solar module producer Aiko in the top five European module suppliers by international solar manufacturer Canadian Solar.

Sun.store said Canadian Solar’s entry into the top five shows both its “strong European footprint” and a “somewhat reduced interest in Aiko”.

The top five list is now as follows: LONGi, JinkoSolar, Trinasolar, JA Solar and Canadian Solar.

“The entry of Canadian Solar into the top five brands and Huawei’s strengthened position in both inverter categories highlight how market leadership is consolidating around a few highly competitive global players. Heading into Q4, the focus will likely shift from price competition to operational efficiency and strategic stock management,” Kierzkowski said.